“Generation rent to generation buy”? Or will it be “Generation buy now, lose out later”?

As the Chancellor of the Exchequer, Rishi Sunak reveals this year’s budget, a bold announcement of 95% mortgages was introduced to help keep the property market a float and give first-time buyers a realistic opportunity to jump onto the property ladder.

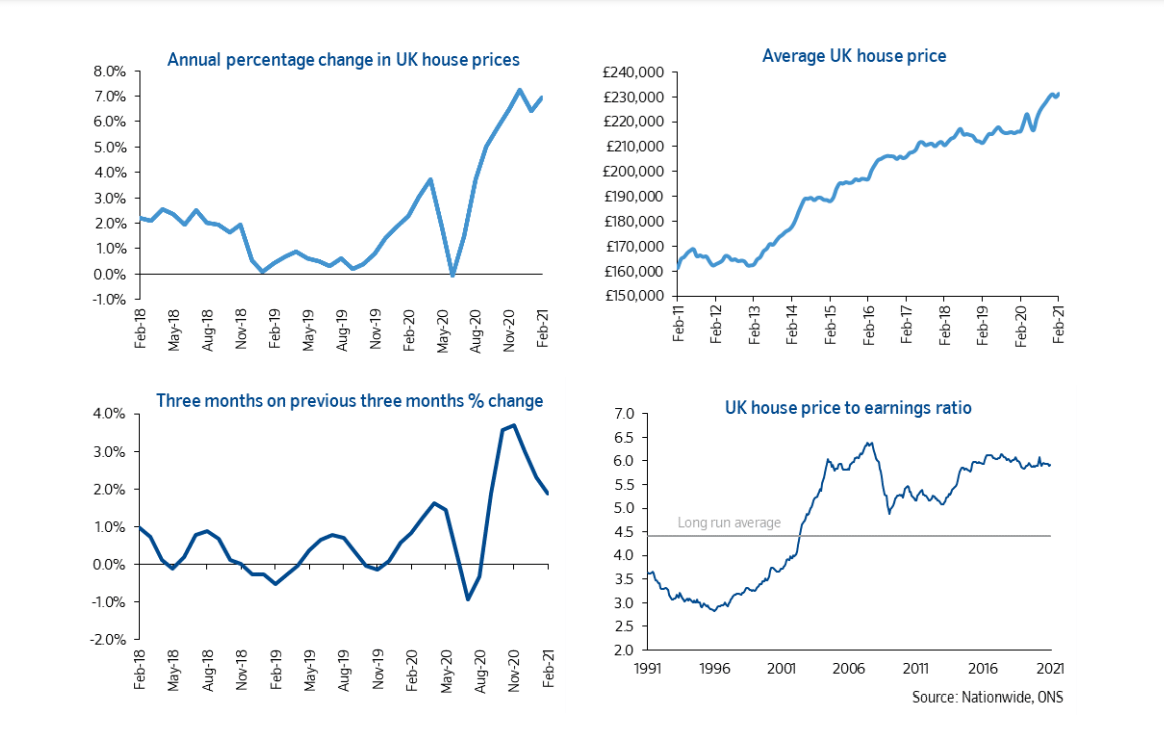

Due to Covid-19, the last year has been dismal for the UK economy. The Government have been constantly forced into making large fiscal decisions to prop up the UK. Schemes ranging from furlough, stamp duty relaxations, additional grants have helped ease the pain across multiple sectors in the UK. In a very poor year for the economy, one thing has continued to rise: house prices.

A 95% mortgage will ultimately offer up the opportunity for first-time buyers to get onto the increasingly difficult property ladder. At current UK average house prices, a first-time buyer would have to cough up around £20K-£25K deposit to achieve a 10% deposit, so a timely drop to 5% on paper will give opportunities for those looking to buy for the first time. It will also give buyers who already own a property a chance branch out to higher-valued property at a lower deposit rate.

Insight Data’s Operations Manager Jade Greenhow comments: “On the face of things, this appears to be a good move all round. It will continue to stimulate house transactions and will hopefully move some first-time buyers away from being stuck in a renting cycle. However, with demand plentiful it’s worth noting this could well continue to push prices up in the short-term.”

With big lenders such as Lloyds, Barclays, and HSBC being named by the Chancellor as adopting the scheme, the question is now how long will 5% be a option on the table for house buyers?

Jade Greenhow comments “It goes without question that the government is propping up the housing market currently. Stamp duty relaxation extension is another weapon in Rishi Sunak’s armoury to ensure that the housing market keeps moving, but as we all know at some point these policies will cease. With that uncertainty, those who enter into a property transaction with a low deposit mortgage could slide into negative equity should house prices fall. This will ultimately make it incredibly difficult for those to sell their properties or remortgage.”

The UK housing market has been understocked for many a year and with this scheme increasing demand for properties, the question of supply will no doubt come into scrutiny once again.

For more information call 01934 808293 or contact Insight Data online today.