Insight Data publishes the 2017 Window Industry Report

Insight Data has published it’s long awaited ‘Fabricator and Installer Report’ which is the most authoritative and comprehensive analysis of the UK window industry and seen as the ‘bible’ of the industry.

The 2017 Insight Report analyses data from over 15,000 fabricators and installers.

Insight Data’s managing director, Andrew Scott, comments:

“The industry is currently facing some challenges with more companies now reporting a slow down in business, some by as much as 15%. However, there are still plenty of opportunities and a number of companies are bucking the trend. The increase in mergers and acquisitions over the last year also points to a realignment of the industry.”

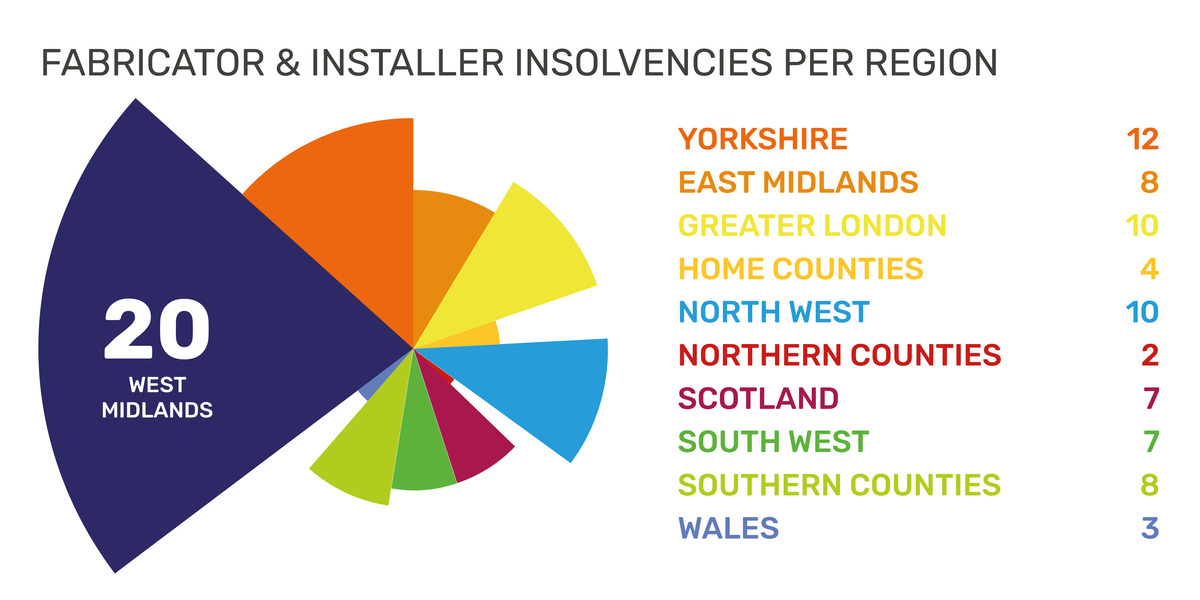

The Insight Report gives a full snapshot of the industry, analysing fabricators and installers by region, sectors, products, financial performance and more.

For your free, comprehensive copy of the 20-page report, click here.

Highlights from the report include:

- Greater competition as the number of window companies has increased

- Fewer PVC-U fabricators, while aluminium remains strong

- Single storey extensions and tiled roof conservatories creating new opportunities

- Trade counters expanding rapidly potentially disrupting the market

- Significant rise in specialist/premium products, such as vertical sliders

The Report is compiled following telephone interviews with over 15,000 companies and analysis of financial data spanning the industry.

The full report includes analysis, trends and opinion on the current state of the industry, and includes detailed information on fabricators, installers, trade counters and the growth of ‘builder installers’ as well as developments in products and materials.

Industry Overview

The previous Insight Report was last published in 2014. Since then, the number of window, door and conservatory companies has risen and now stands at 15,099. There has been significant ‘churn’ over the last 3 years, with 1,592 firms being removed from the database and 1,920 businesses added, giving a net increase of 328, largely consisting of small installation firms.

The companies removed from the database include those that have gone out of business, merged, or changed direction/markets, but an increasing number are firms where the owners have retired and the business has ceased trading.

Across the fenestration industry, the number of manufacturers stands at 4,852, of which 4,178 are window and door fabricators, the balance being specialist composite door, conservatory roof and sealed unit manufacturers.

Window and Door Fabricators

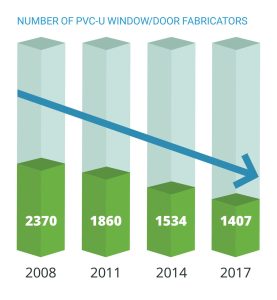

The number of PVC-U window and door fabricators continue to decline year-on-year and now stands at 1,407 companies, down from 1,534 in 2014. However, the rate of decline has slowed – there were 2,370 PVC-U fabricators in 2008.

Small fabricators (100 frames per week or less) have seen most upheaval, with a significant number making a decision to either cease manufacturing or investing in growth. This is reflected in an increased number of PVC-U fabricators manufacturing 100 – 250 frames per week compared to 2014. At the other end of the scale, the number of fabricators producing 1,000 + frames per week has also marginally increased.

Most PVC-U fabricators are now offering a broader range of products; either to improve revenue or margins, or to secure customer loyalty. Some companies have increased their manufactured range, while others are distributing products from specialist manufacturers.

Fewer PVC-U fabricators are switching system companies completely, although more fabricators than ever are manufacturing more than one system.

There are 175 PVC-U fabricators who dual or multi-source source, while a number of mergers/acquisitions have led to several fabricators within a group manufacturing different systems to satisfy market demands.

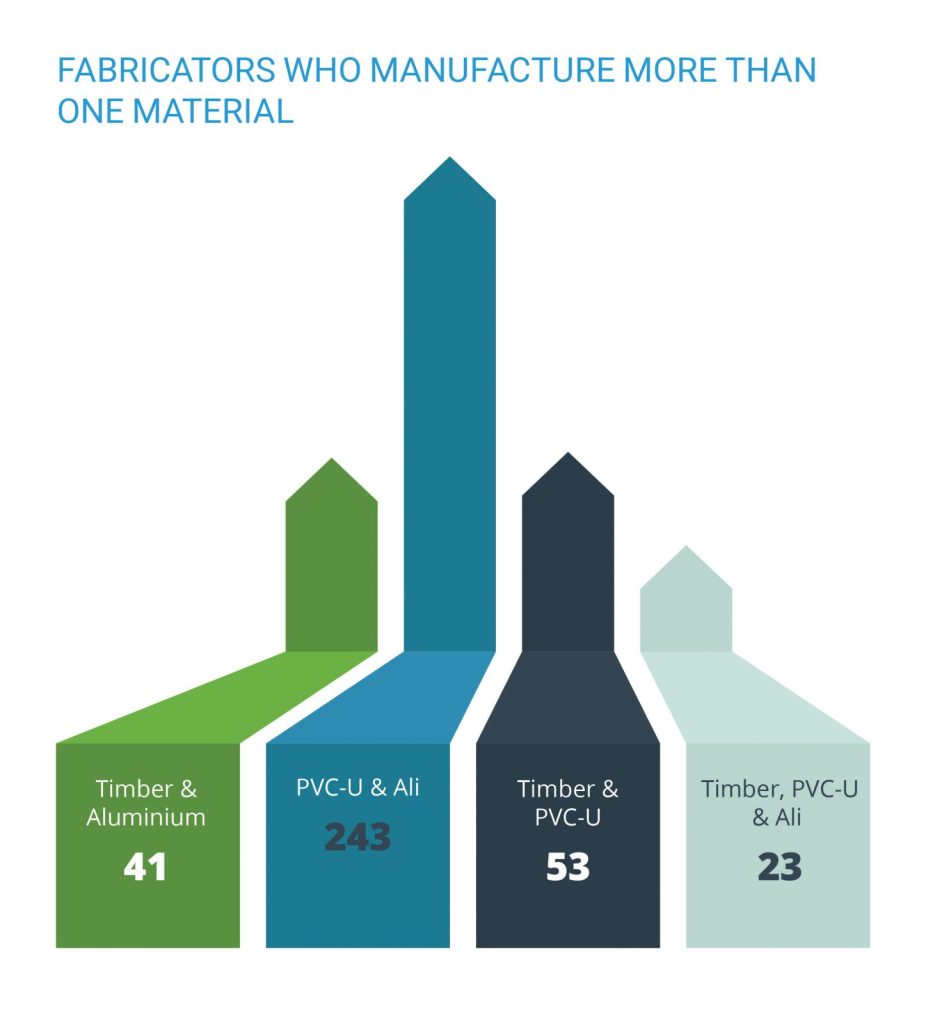

In contrast, aluminium fabricators have remained consistent over the last 3 years at around 800 firms, although the nature of companies has changed. Smaller commercial aluminium fabricators have pulled out of manufacturing or ceased trading, but there has been a significant increase in PVC-U fabricators now manufacturing aluminium, with 243 fabricators manufacturing both materials.

Double glazing Installers and trade-counters

The number of window, door and conservatory installation firms has risen over the last 3 years to 13,281 firms; the increase primarily among small businesses (1 – 25 frames per week). In recent years a significant number of fitters have left their jobs with the large nationals and set up their own small installation business, often sourcing products from an increasing number of trade counter outlets.

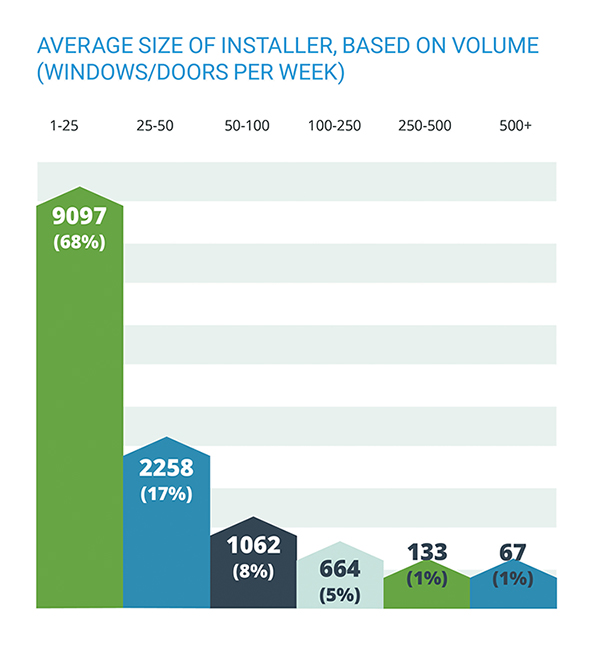

The vast majority of installation firms (9,097) are small, fitting 1 – 25 windows/doors per week, while 25% (3,320) are fitting 25 to 100 frames per week, which is the ‘sweet spot’ for most trade fabricators.

Installers can be split into two groups, those that fabricate and install, and those that buy-in and install. While there are exceptions, those that fabricate tend to be larger and have faired better financially.

Installers have diversified; extending their range of products to include additional niche window/door products and other home improvements such as garage doors and driveways. One of the most exciting opportunities for installers is renewed interest in conservatories, although the nature of the product is changing.

Consumer demand for replacing conservatories or conservatory roofs with better performing, all-year-round solutions has risen sharply, while over the last 3 years several major suppliers have launched new solid roof solutions giving installers the opportunity to increase order values and provide larger, more complex home extensions.

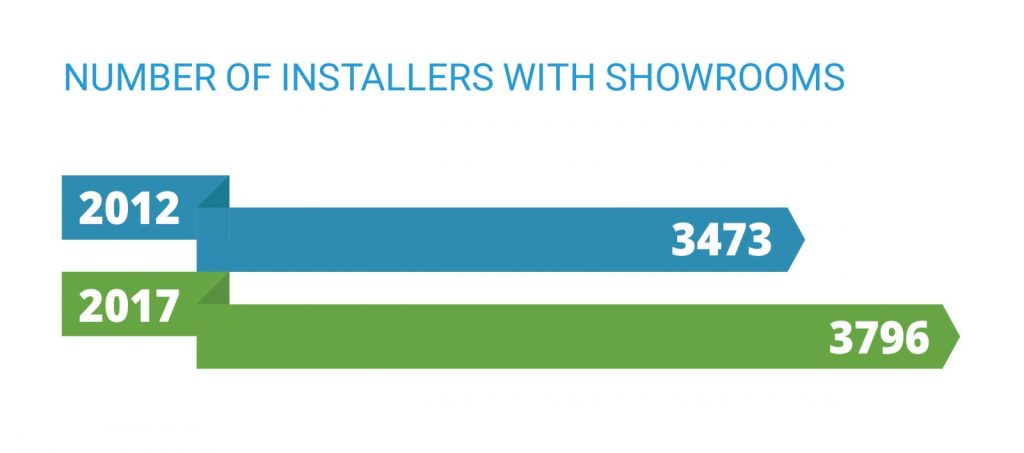

New product innovations have led to a notable increase in companies investing in showrooms, which is counter-intuitive in today’s online market place. Indeed, the number of showrooms has increased from 3473 in 2014 to 3796 in 2017, reversing a trend in earlier years.

While the number of installers fitting PVC-U windows and doors has remained largely unchanged, since 2014 there has been a 40% increase in firms offering aluminium and a 25% increase in timber installers. 6,353 installers now offer aluminium and 5,468 offer timber products.

Trade counters continue to evolve with a notable increase in acquisitions over the last year as companies focus on distribution channels and volume. 876 trade counter depots now supply windows, doors and conservatories, supplying both small installation companies and a rapidly increasing number of builders who offer this product range.

Indeed, the number of builders who buy-in windows, doors and conservatories stands at 15,739 firms, well ahead of the 9,553 traditional double-glazing installers who buy-in frames.

The Insight Report

The full Insight Report provides in-depth analysis of the industry, including product information, markets and financial data. For a free copy of the report click here.