Looking back at our PVC-U Fabricator 2019 report

In December last year, Insight Data published a review of 2019 for the PVC-U Fabrication industry. 190 of the top fabricators across the UK were telephoned and asked questions about their business and the wider industry. The PVC-U Fabricator 2019 report showed that many fabrication businesses felt a sense of confusion on where the industry was heading.

Despite what we know now about the way 2020 has turned out, back then, many felt that the fenestration industry was in the throes of a difficult process of evolution.

Almost a year later we look back at that report and comment on how Covid19, a global recession and Brexit are continuing to change the fabrication industry.

The PVC-U Fabricator 2019 report

The review was based on our own market intelligence data. A survey was carried out on a sample of PVC-U fabricators within the UK in December 2019. The review particularly focussed on several industry factors: the industry’s confidence in the past and into the future, general industry trends, any growth blockers in place and the future of the sector.

In preparation for insight Data’s 2020 Fenestration Industry report, this article looks at each topic and provides commentary on how 2020 has impacted the wider fenestration industry.

An industry in decline?

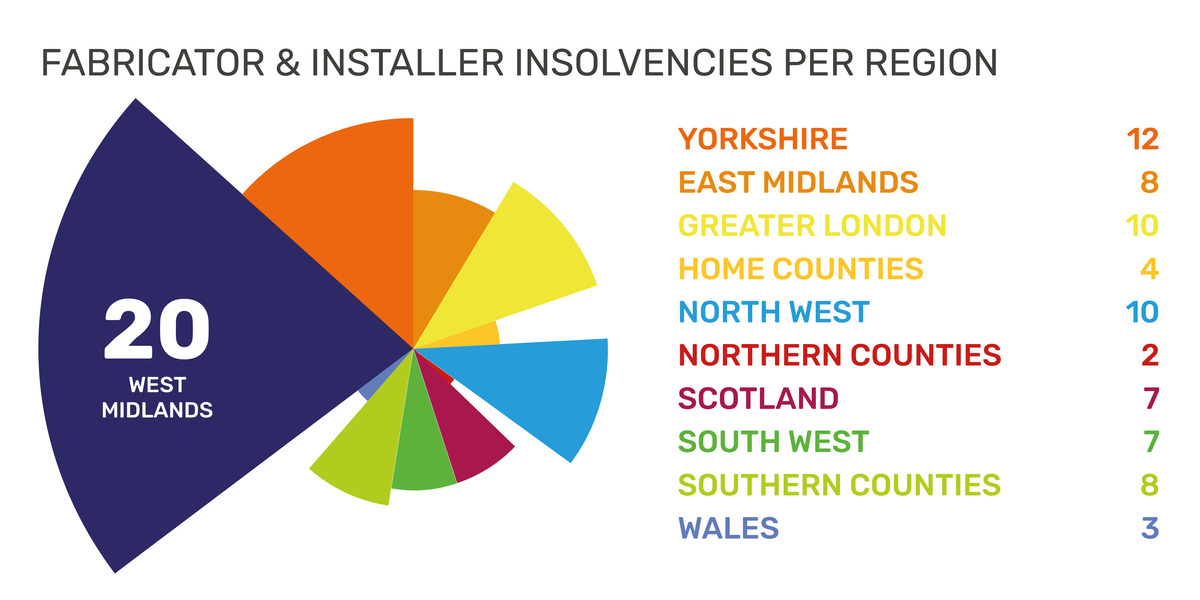

Since 2008, the amount of companies fabricating PVC-U has declined by 46.5%. 2019’s report revealed that between 2017 and 2019, 140 UK PVC fabricators went out of business. Based on projections in a ‘worst case’ scenario, it was estimated that by 2024, a mere 773 PVC-U fabricators will remain. Should things improve by 2024, it’s estimated 1,103 fabricators will be trading in the UK (based on current trends).

It was not just the small retail ‘lifestyle’ businesses packing up, but based on frames per week, larger fabricators were shutting their factory doors. 8.5% of fabricators either closed their business, ceased fabricating or reduced their frame per week output since 2017.

Obviously, we have not reached 2024 yet but 2020 may have accelerated that decrease. Insight data are currently polling the fenestration industry in preparation of our 2020 report. The picture will become clearer when this data has been collected but we predict that 2020 events will have changed the industry in a profound way.

We suspect that most of the bigger companies were probably better suited to survival as they have more resources, the full force of the impact may have been cushioned by pre-existing work pipeline. However, smaller companies have a greater ability to pivot and adapt quicker to changing business challenges. We at Insight Data expect to learn more about how varying scales of businesses have fared through our 2020 data.

Diversification the key to survival?

Despite a decline that has been happening since 2008, the 2019 report showed that the remainder of the industry remained strong. As of 2019, 23% of PVC-U fabricators had adopted aluminium into their portfolios. Aluminium continued its surge into the domestic market with high-end products such as bi-fold doors and sliding doors.

PVC-U high-end products were also popular. Vertical sliders and flush casements were (and continue to be) in-vogue alongside recent developments in more colours and foils than ever before. This innovation demonstrates the adaptability of the fenestration sector.

Duel sourcing was on the increase with 23% of businesses polled fabricating both PVC and aluminium. However, PVC was still king with 73%.

With PVC accounting for such a high proportion of industry output we wouldn’t be surprised if we start to see evidence of an increase in duel sourcing this year. During the first national lockdown, the RMI market for domestic housing spiked as consumers invested in their own homes. This will have created more demand for in-vogue products so expect to see more companies diversifying into this market in the future.

The biggest challenges facing the fabrication industry

In 2019 Brexit was the largest looming threat to polled businesses. Raw material costs were a close second – a possible connection to Brexit negotiations uncertainty. Suppliers from outside the UK in all industries were acting cautiously due to a lack of clarification on what the UK’s position was on Brexit. Skills crisis, a decreasing market, competition and demand in products were also other sources of anxiety.

How one year can change everything! Events in 2020 have eclipsed previous worries around the uncertainties of Brexit and a shortage in materials. Instead, businesses all over the world have been forced to put their teams on furlough and have experienced huge spikes and troughs in work in the space of 6 months.

This topsy turvy ride has left many in the fabrication industry guessing on how 2021 will look. Without an end in sight, we expect to see the Covid 19 Pandemic being the biggest challenge the industry has faced throughout 2020 and into the future.

The rise of automation: factory machinery use on the up

When respondents were asked whether an increase on investment for more automation within factory machinery in the next 3-5 years will occur, 54% agreed and 34% disagreed.

Without a doubt, technology and innovation continue to shape UK businesses across all sectors regardless of pandemics, recessions or any other challenges. Technology brings growth and opportunity, but in the fenestration industry, it is still met with an air of caution.

PVC-U fabrication works hand-in-hand with skilled labour and technology. The larger fabricators will achieve growth by investing in automation, while smaller fabricators may not necessarily see the value in large investments in machinery for minimal fluctuations in productivity.

We don’t see this changing any time soon. As businesses pivot to a new normal expect to see more and more businesses embrace technology and automation.

Insight Data collect and sell prospect data for the fenestration industry. They regularly research trends across several key areas of the trade and commercial sectors to provide in-depth analysis to their clients. Their new fenestration report will be published at the end of 2020.

Note – this article appears in Total Fabricator magazine.