Compiled following in-depth research of some 15,000 fabricators and installers, the annual Insight Market Report, produced by Insight Data, provides the clearest, most concise snapshot of the UK window, door and conservatory industry in 2014.

The year ended with 14,771 fabricators and installers on the Insight database. There were over 1,200 changes every month on the database, but it is the number of companies added to the database and those being removed (ceased trading) that gave a strong indicator of churn in the market.

During the year 455 new companies were added and 819 removed; business failure and a growing number of business owners retiring are responsible for the increase in ‘ceased trading’.

Read the overview below, and download the full 13 page report for free – click here

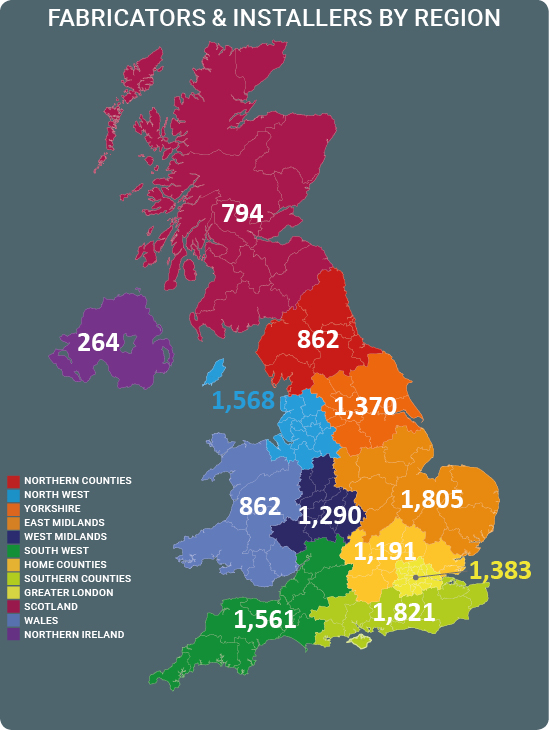

Regional Activity

The Southern Counties is the UK hot spot for window companies, with 1,821 trading firms, followed closely by the East Midlands, while the Northern Counties saw the highest net increase in firms with an additional 18 companies in the area taking it to 862 firms. Northern Ireland had the lowest number of companies at 264.

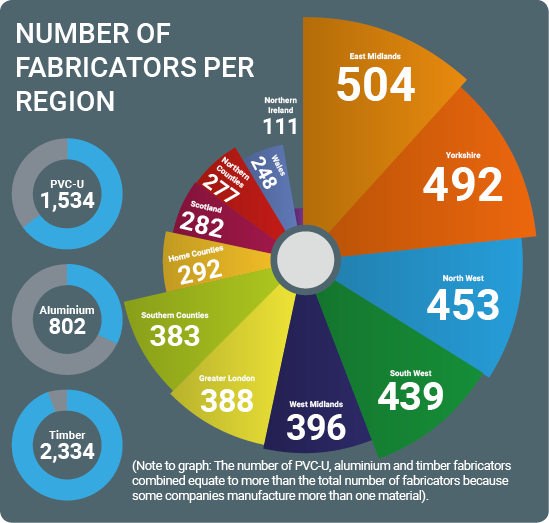

Manufacturing

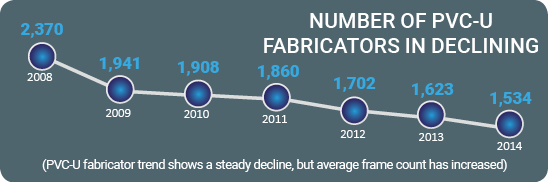

The number of PVC-U, aluminium or timber manufacturers now stands at 4,265 with the East Midlands having the highest number of fabricators and Northern Ireland the lowest number.

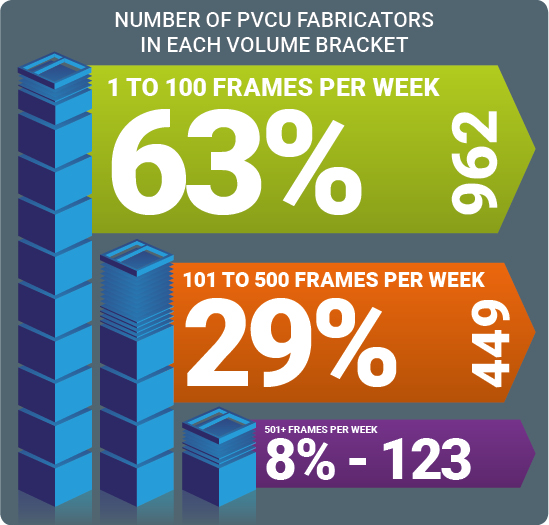

One of the most notable changes in 2014 is ‘lifestyle fabricators’. Small companies producing under 50 frames per week have historically been content fabricating for themselves. However, there has been a significant swing away from manufacturing at this level, with the number of small fabricators dropping by 94 during 2014. 63% of PVC-U fabricators manufacture 1 to 100 frames per week.

Installers

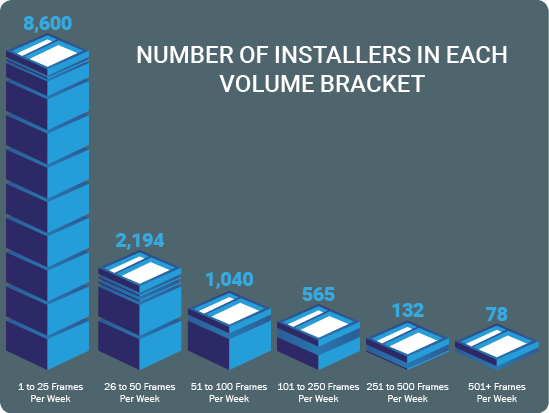

The number of window, door and conservatory installers has increased for another year and now stands at 12,609 firms. The market is still dominated by small companies, with 8,600 installers fitting 1 to 25 frames per week.

The landscape for installers is changing. Many have now become home improvement companies rather than specialist window companies, and offer a wider range of products such as garage doors or roofline products.

Meanwhile, there are now over 22,000 local builders active in home improvements, extensions and self-build projects all of which can include windows, doors and conservatories.

In the last 12 months the activity among builders has increased dramatically. With the growth of trade counter outlets builders can now offer the same products as traditional installers without the overheads and sales/marketing costs associated with a typical double glazing business.

As a result traditional installers are seeking ways to differentiate their product offering. One way of doing this is a showroom, and it is interesting to note that after many years in decline, the number of companies with a showroom presence has risen sharply in the last two years and now stands at 3,473.

Diversification

Of the 12,609 installers 10,706 buy-in products from a fabricator or trade-counter depot, while the balance continue to fabricate and install.

Diversification was an underlining theme of 2014. Aluminium windows and doors, including bi-folding doors and patio doors, are now offered by 4,834 installers, an increase of 291 compared to the previous year. But it isn’t all about aluminium; installers continue to promote premium PVC-U products including flush sash and coloured frames.

The stand-out PVC-U product in 2014 was PVC-U vertical sliding sash windows, with 7,495 installers now actively offering this product, an increase of 600 firms compared to 2013.

Trade Counter Growth

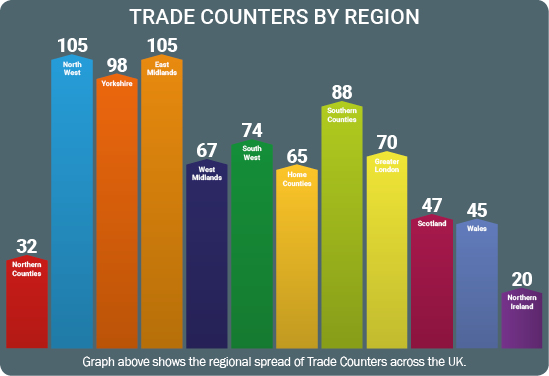

The single biggest shift in the window industry is in distribution channels. Trade Counter Depots supplying products directly to local installers, builders and other markets (including DIY or self-build) is the big growth market.

Trade Depots can be wholesale/re-sell models, whereby the operators buy-in products from manufacturers and sell through their trade counter, similar to small builders merchants, or they can be vertically integrated whereby the manufacturer is operating their own outlet to supply local markets.

Several major PVC-U fabricators are now recognising the growth potential and benefits of a vertically integrated distribution network and have launched, or are launching, their own networks.

It is this growth in trade counter networks that is fuelling the ‘Builder Installer’, with over 22,000 local builders now actively offering windows, doors, conservatories and other products directly to consumers. Trade counter depots are changing the traditional business channels and disrupting the market.

We predict that as window companies evolve into home improvement specialists and builders capitalise on the availability of window and door products through trade-counters, the line between installer and builder will dissolve, and we will see 34,000 home improvement companies.

This is an excerpt from the full report, which contains in-depth analysis. To download the comprehensive report for FREE click here.