UK installers switch to new fabricators en-masse in 2020

An astonishing 23% of window and door installers in the UK have switched PVCu fabricators since March 2020. Based on a survey Insight Data carried out in October 2020, we estimate that almost a quarter of 7,825 PVCu installers have switched fabricators this year.

This development could have a significant effect on the glazing industry in both the short and long term. In this article, our industry expert, Jade Greenhow, looks at why so many installers have switched to different fabricators, and how the industry could change because of this movement. She believes there are three possible reasons why so many installers have decided to change to a different supplier.

1. Demand for glazing has gone up

“2020 has seen a huge increase in demand for glass products. As the UK went into lockdown in March, consumers have invested heavily in their homes. Inevitably, installers frantically tried to source products to meet that demand. In short, the market has been very busy since the emergence of the COVID-19 Pandemic in the UK.

Fabricators have pushed capacity to the maximum, which in some cases reported delays in the supply chain. In times where consumer confidence could crash at any moment, desperate installers who previously were loyal to single fabricators were forced to shop elsewhere. It will be very interesting to see how the market shapes once the demand inevitably slows. Will the previously devoted installers go back to their original fabricator, stick with their new one or keep shopping around?”

2. Less fabricators to choose from

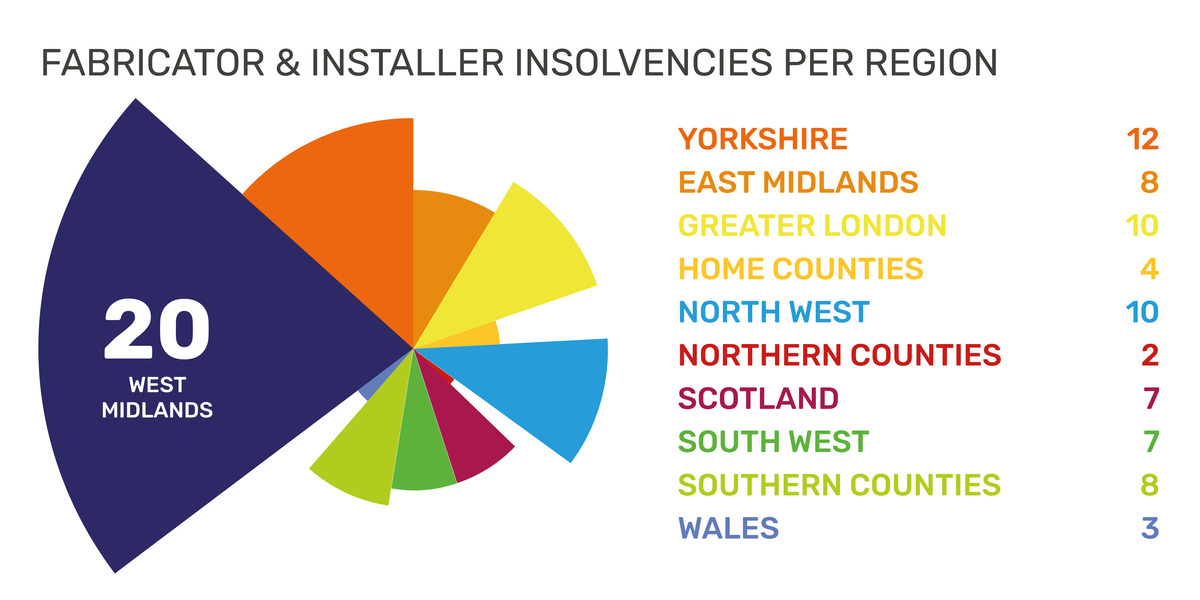

“There have been casualties this year within the Fenestration sector. Sash UK and Polyframe Halifax are two such fabricators that have been terminally affected by market factors and challenges. If big fabricators keep disappearing, the landscape will look very different. In the last ten years the number of UK fabricators has shrunk by almost 33%. That is a drop-off of almost a third since 2010.

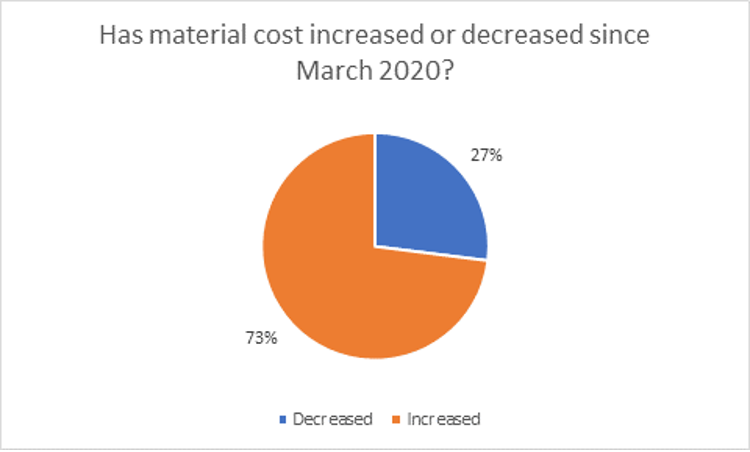

When there are less fabricators, prices can be increased because the surviving fabricators have a monopoly on total output. Alongside the increased interest in glazing, which has been seen since March, we know that when demand increases and supply remains the same, or even decreases, with big fabricators going bust, the higher demand leads to a higher equilibrium price. 73% of installers noticed an increase in price since March 2020.

3. Forward thinking fabricators are picking up the pieces

“With all crises there are winners and losers. Opportunities arise and installers are inclined to switch fabricator more than ever. The two factors above have undoubtedly shaped the trend for installers switching, but fabricators who have a consistent marketing presence and send out the right messages have picked up the installers who are looking elsewhere.

Installers need reliability on supply, price and product quality. By getting the right message out to the right audience now is a safe investment to pick up business. New installers with higher spending habits are ready and waiting to use a new fabricator. The fabricators who do nothing, are the ones set to miss out.”

Insight Data can help you to target installers

This is where we can help you. Insight Data can help you to discover installers that need your product. Our prospect data lists are fresh and accurate so that you can be sure you’re contacting the right people. Our live database software also allows our customers to directly connect with those prospects in a meaningful and effective way.

Our data solutions not only offer the ability to discover and connect with the best prospects for your products. Our innovative sales and marketing, live data CRM platform enables businesses to manage their existing customers too. Crucially, all of the products and services we offer provides vital business and sector intelligence.